Market Overview

Wheat/Barley

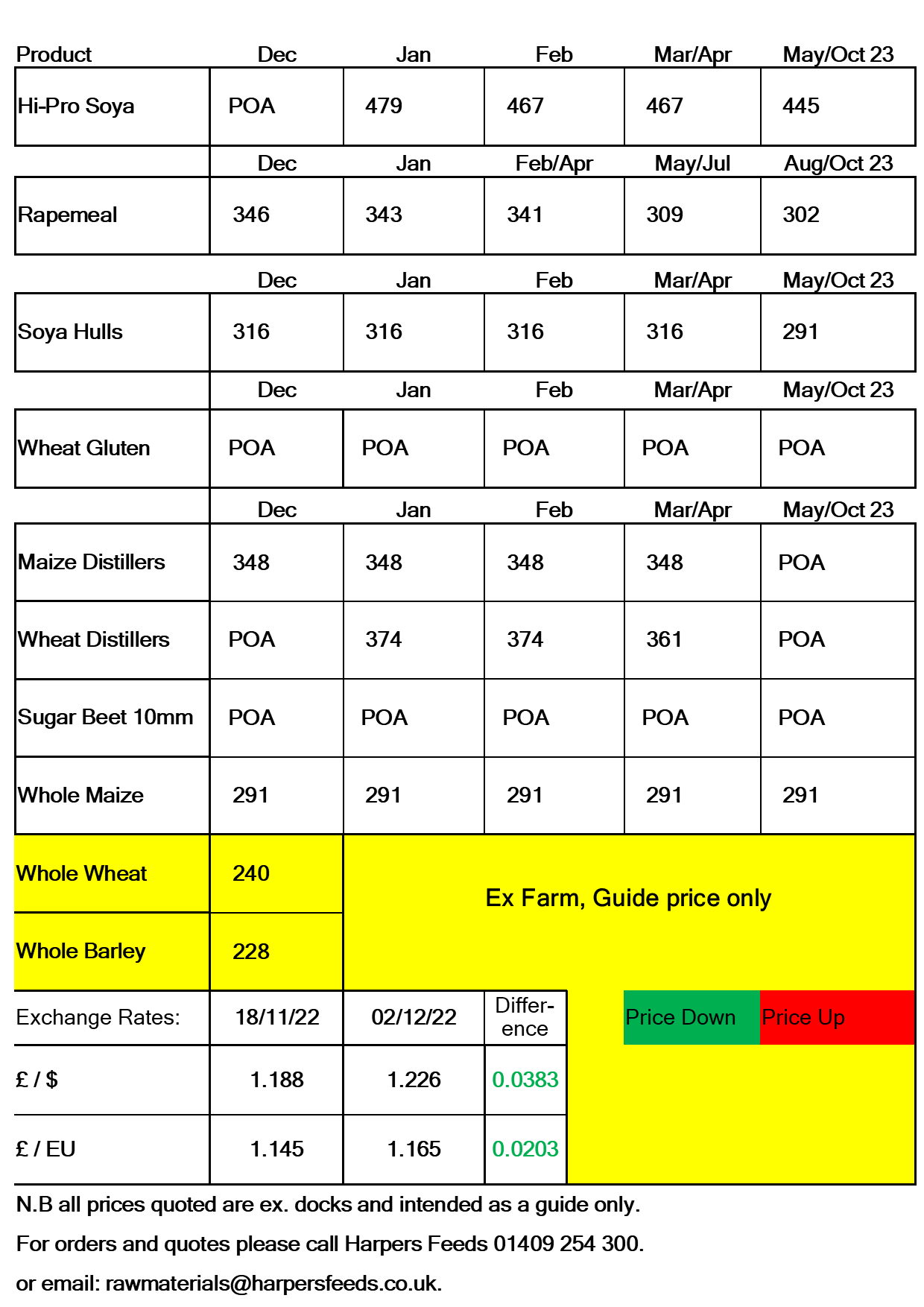

Grain markets have come under pressure throughout November as the renewal of the grain export corridor from Ukraine through the Black Sea was extended to 19th March 2023.

The strength of the pound to the US dollar and Euro has also been a factor in domestic wheat and barley prices easing. Thursday saw Uk Feed Wheat Markets close at £242.60/T; levels not seen since before Russia invaded Ukraine in February.

Ukraine wheat exports are estimated at around 30% lower than last year’s levels.

Watch points going forward will be on global demand which is expected to reduce due to recent issues with Avian Influenza (AI). The strength of the pound against the US dollar/Euro and changes to global production will also be key to market direction.

Domestic barley prices continue to be navigated by wheat, currently valued at a £12 to £15 discount to UK wheat prices.

Hi Pro Soya/Rapemeal

The increased strength of the pound has also helped put pressure on products such as Hi Pro Soya. For the short-term, soya supply remains tight which is reflected in current prices but for the long-term there is potential for prices to come under pressure due to lower demand and possible record production.

Brazil is estimated to produce 152MT of Soya compared to 126MT last year. Cuts to production are expected as we move through the start of 2023, but if realised, a record crop could put pressure on global prices.

Due to China’s ‘Zero Covid’ policy, demand is currently low which is also having an effect on market direction. However, if China were to enter the market again, this could offer support to global Soya prices.

The USDA estimates the 2022/23 rape seed supplies to increase 11MT year on year to 84.4MT and crush that crush will increase 6Mt year on year.

Maize

According to the USDA, Brazil is estimated to produce 126MT of maize, 10MT more than last year. Argentina is estimated at 55MT, up 5MT from last year. Combined the two are going to account for 48% of global maize exports for the current marketing year. Focus will now turn to South American weather, with Brazil and Argentina experiencing dryness and lack of rainfall. Although not as severe in Brazil, the critical growing season is from now until February and any worsening of conditions could give support to global maize prices.