Market Overview

Wheat/Barley

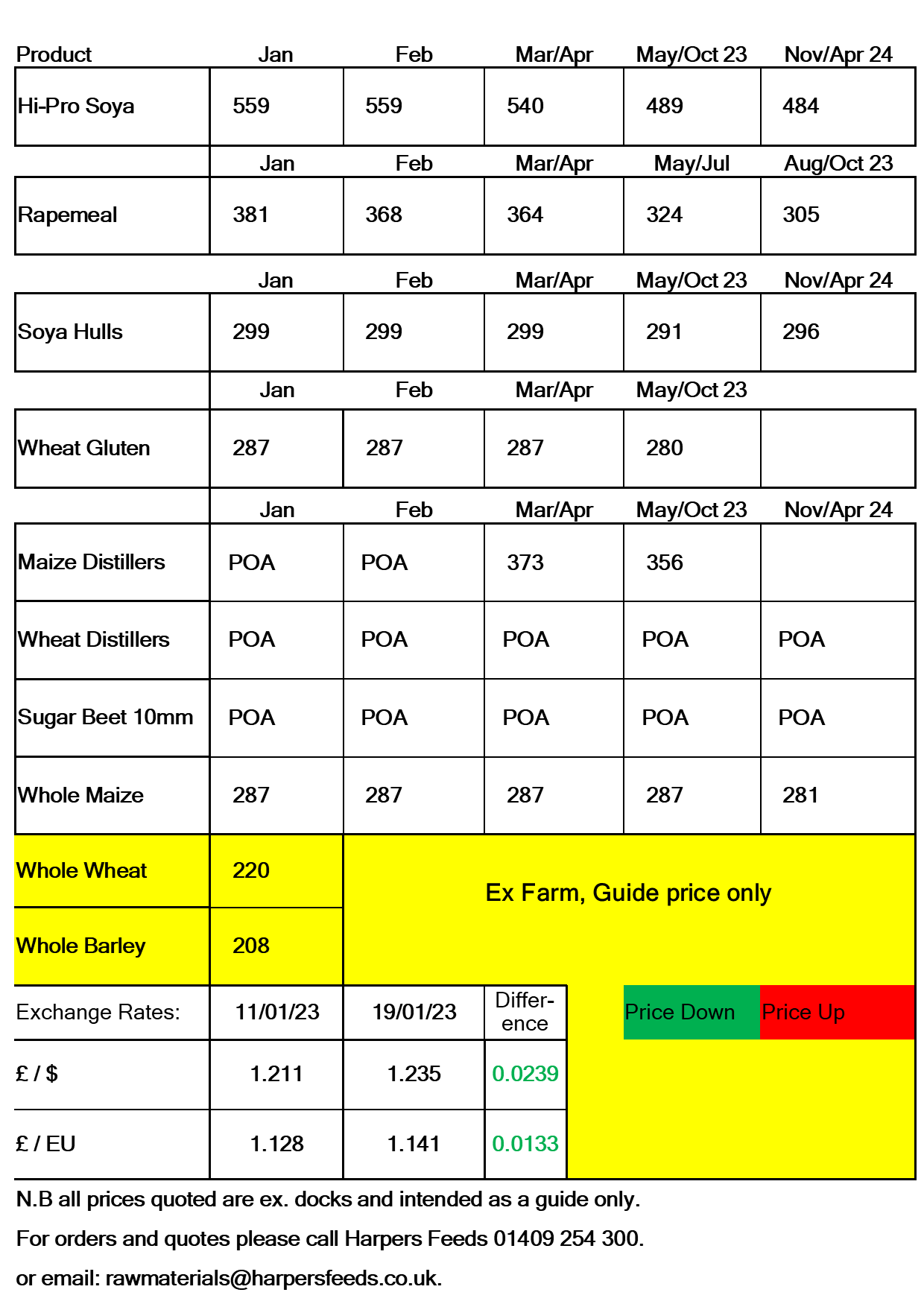

Since the Black Sea Corridor renewal was agreed in November, UK Feed Wheat markets have been under pressure with prices easing slowly week by week. This has also been aided by the abundant and competitive grain supplies seen through the Black Sea, predominantly from Russia.

Much of the risk premiums added to global markets for grains are considered to have been removed for now. The situation between Russia and Ukraine remains volatile and any new escalation in conflict could see these premiums begin to rise again and impact the capacity Ukraine can produce and export.

Going forward, Chinese demand will be a key watch point now covid-19 restrictions are being eased there. Any adverse weather conditions in areas such as South America, the US and Europe will also be something that could impact market direction.

Following last weeks USDA report, the overall 2022/2023 global wheat outlook is for increased supplies, exports, consumption and stocks. Barley continues to track domestic wheat prices, currently at a £12 discount to wheat.

Maize

Last weeks USDA reports outlook for 2022/2023 is for lower production, usage and stocks. US production was cut back by 5.1MT, Argentina by 3MT and Brazil by 1MT. These cuts were slightly offset by an increase of Chinese production of 3.2MT to 277.2MT.

Ukraine exports were increased by 3MT. The tightening to global supply combined with the recent dry weather conditions in Argentina and high global demand, are all bullish factors for global maize prices going forward.

Hi Pro Soya/Rapemeal

Although the USDA increased Brazil’s production by 1MT to 153MT last week, the increase was more than offset by cuts to production in other key areas. The recent drought in Argentina has resulted in a production cut of 4MT to 45.5MT. US production has been revised down by 1.9MT and many private forecasts feel the new figures are still to high. World Soybean exports have been reduced by 1.85MT on account of smaller shipments from the US.

Going forward the key watchpoints will be the weather conditions in South America, in particular Argentina. Significant rainfall is forecast in the coming days which is desperately needed by following recent drought conditions.

Global demand will also be a key area for market direction. China have been quiet in the market, mostly related to their recent issues with Covid-19 restrictions and cases. However these restrictions are slowly being lifted and if China were to enter the market again, prices could find support.

For the short-term rapeseed supply remains tight. Long-term a large European rapeseed crop is due.

The start of 2023 continues to be volatile for Grain and other raw material markets.