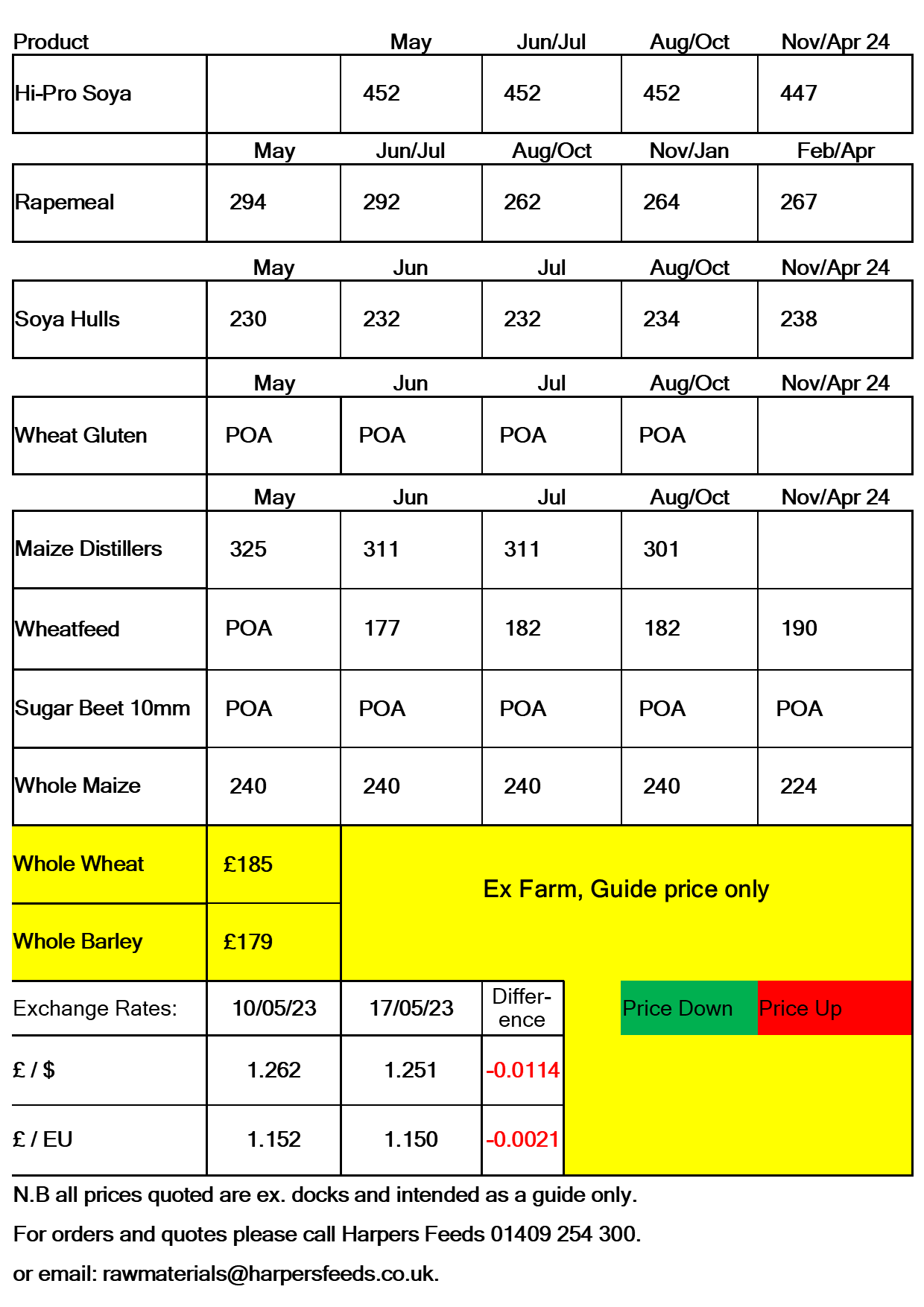

Market Overview

Wheat/Barley

The renewal of the Black Sea Grain corridor remains uncertain. The current deal is due to expire tomorrow (May 18th) and the prolongation of the deal is yet to be confirmed despite ‘positive’ negotiations last week.

No further talks have been scheduled this week between all parties involved with the agreement. If the deal were to fall through, we would likely see some support given to global grain prices and volatility to increase. Ukraine is targeting to export 40MT of grain in 2023/2024.

Away from the grain deal renewal, much of the markets focus has been on the New Season Supply & Demand report (WASDE) released last Friday. The report highlighted a record global production forecast for wheat, with estimates at 789.8MT. However this figure was offset by estimated global ending stocks at 264.3MT, the lowest seen since 2014/2015. India have reported a drop in stocks of up to 10MT. The overall US wheat production estimate was lower than market expectations at 45.2MT.

Barley continues to track the wider grain complex. The discount of ex-farm UK feed Barley to UK feed Wheat has narrowed to levels under £10/T.

Maize

Going forward, global maize prices will be impacted by the Black Sea grain corridor deal. The latest WASDE report set out larger global supplies, increased global demand and increased global ending stocks. The big surprises came from the 2MT cut in US exports and the increase to the world 2023/2024 ending stocks. Most of this was due to the larger estimates given to the Brazilian crop (130MT).

Hi Pro Soya/Rapemeal

The first new crop (2023/2024) estimates from the WASDE report confirmed that a record US soybean crop is expected. The first initial estimates pegged the crop at 122.7MT, up 5% from last year. US soybean planting is estimated at 49% complete, ahead of it’s respective 5 year average.

Brazils Soya production was also increased by 10MT to 163MT, surpassing this seasons record. The price outlook remains bearish due to the record Brazil crop and global production estimates for 2023/2024 which would also be a record.

Rapeseed production year on year is expected to grow in both the EU and Canada, partly offsetting the lower rapeseed production in Australia. The global market supply is anticipated to remain favourable with global ending stocks growing in 2023/2024.