Market Overview

Wheat / Barley / Maize

Grain markets entered a period of volatility in the last couple weeks on the back of a bullish USDA report and poor weather conditions.

Friday’s USDA report was considered bullish for wheat, with 2024/2025 global ending stocks coming in 4MT less than market expectations and currently at a 9 year low.

Private forecasters feel further cuts could be made in June’s USDA report, especially to Major exporters such as the EU, UK, Ukraine and Russia.

The first USDA crop estimates were also released on Friday. UK wheat is estimated at 11.2MT, down from 13.98MT seen in 2023/2024.

Russian wheat is estimated at 88MT, down from 94MT. Many feel there could be further downgrades for Russian wheat due to ongoing dry weather and frost damage. If realised, grain markets could gain further support.

Long term, a tighter outlook for 2024/2025 continue to push wheat prices higher.

Barley 2024/2025 global ending stock:use ratio is now tightest has been since 2000. Predictions indicate a larger global crop but this will be eclipsed by demand.

For maize, weather in South America remains a key watchpoint both short and long term. Brazil’s and Argentina’s maize crop were reduced by a combined 4MT.

Despite this they are still projected to produce a combined crop of 178MT, up 3MT from last year so any further weather issues could influence market prices.

The USDA reports 2024/2025 global maize ending stocks down 6MT.

The US maize crop is 49% planted vs 54% average pace due to wet weather conditions. The US crop is estimated at 377MT, down 12MT from last year.

Hi Pro Soya / Rapemeal

Ongoing strikes in Argentina gave support to soya prices in the past couple weeks, reducing crush in the country. The strikes have since been stopped but the potential for more strikes in the coming weeks is a key watchpoint.

Heavy flooding in South Brazil, the largest producer & exporter of soybeans has cast concerns over crops where harvesting is not complete.

The USDA estimates a combined Brazil and Argentina soybean crop for 2024/2025 at 220MT. This is above the 2023/2024 estimates of 204MT so any weather issues could cut crop production and lend support to global prices.

The US soybean crop is 35% planted vs 34% average pace. Surplus rainfall across key states has challenged planting progress.

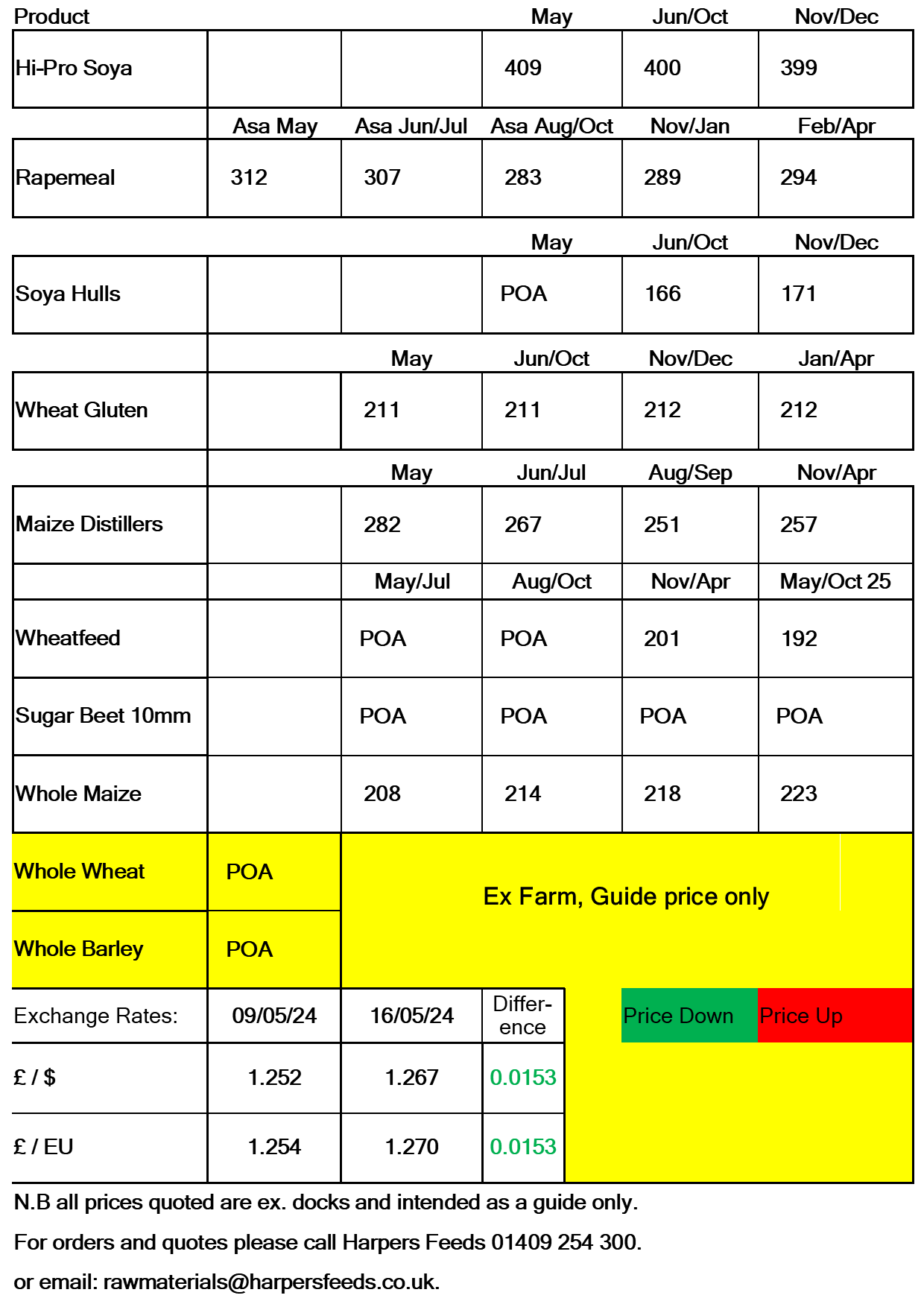

Rapemeal stocks in the UK have become tight for the May/Jul period and this has been reflective in domestic rapemeal prices.

Smaller rapeseed crops for 2024/2025 in the EU and Ukraine are to be partially offset by higher production in Australia and Canada.

With minimal changes in global rapemeal production year on year, we could see markets come under some pressure when new crop stocks arrive.