Market Overview

Wheat / Barley / Maize

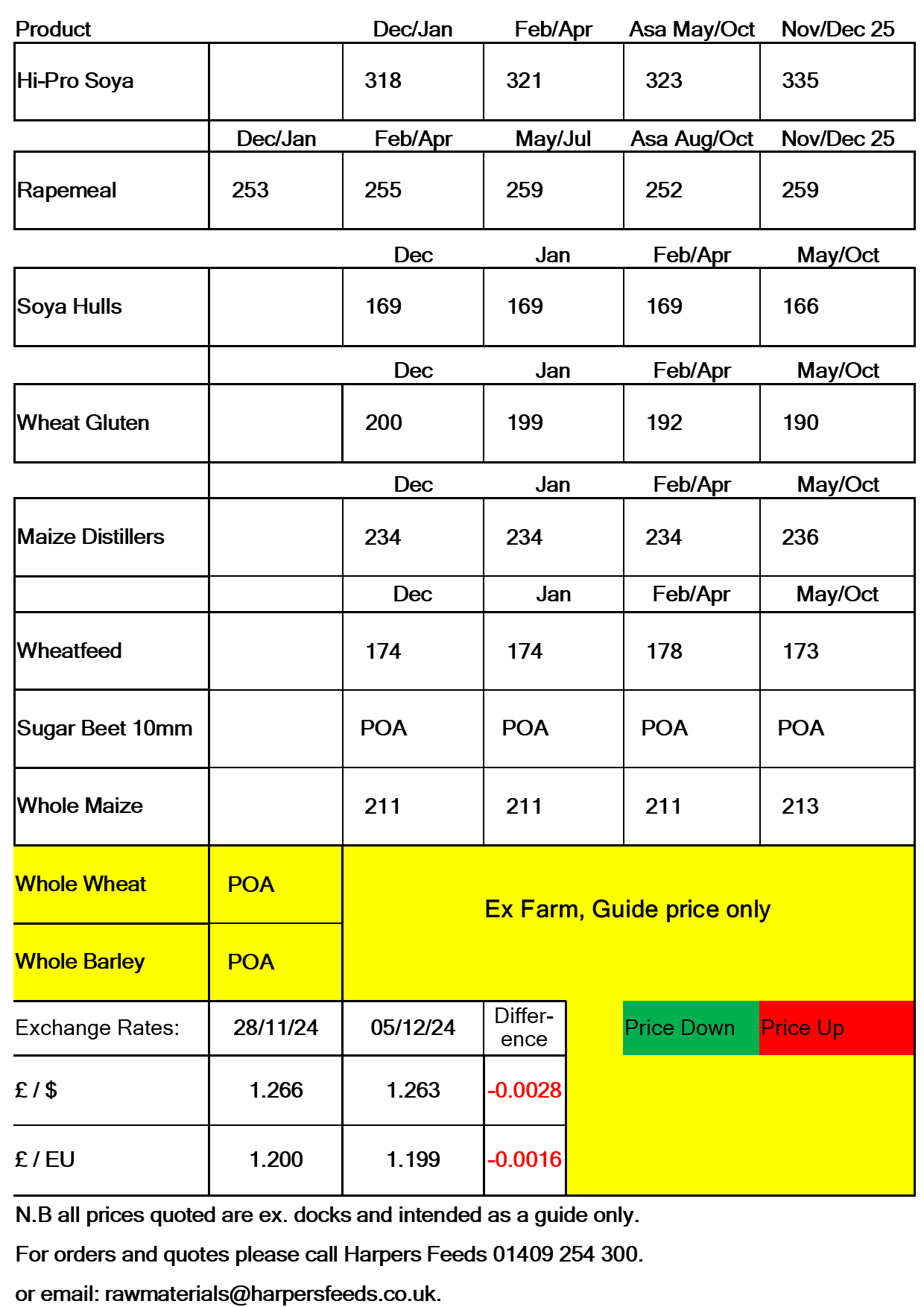

The announcement of the Russian wheat export cap offered minimal support to global cereal markets. Domestic wheat and barley prices have remained fairly stable over the last few weeks as continued competition from Black Sea origins weigh on the market.

However this is certainly a key watchpoint going forward as SovEcon cut its Russian wheat export forecast by 1.8MT to 44.1MT which is now 8.3MT less than last year. This was in anticipation of Russia announcing the wheat export quota.

The AHDB & DEFRA have put UK wheat production at 11.05MT, 3MT lower than last year. Wheat imports have doubled from figures seen last year and at the current levels, growers are reluctant sellers. Barley is estimated at 7.2MT, up 0.25MT from last year.

The AHDB have also released the first report on GB Winter crop conditions for harvest 2025. As of 25th November, 44% of Winter wheat was rated good/excellent condition, with 18% not yet planted or emerged. Winter barley was rated at 57% good/excellent condition, with 7% not yet planted or emerged.

Long-term, favourable conditions in Europe aids the winter wheat establishment. However, it is difficult to see if this will add much more pressure with current cereal prices considered to low for growers.

Barley is currently trading at a £15/T discount to wheat.

Rapid US maize exports continue to offer short term support to global markets.

However, Donald Trump has threatened to impose a 25% tariff against countries such as Mexico, the top buyer of US maize. This has raised doubts over future sales and talk of Mexico looking to other countries to source maize.

In South America, Brazil’s Safrinha maize crop is at risk of delayed sowings after the lag to plantings of the soybean crops that proceed it.

There is a lot of uncertainty in the global maize market, as so much remains unknown about the US political agenda ahead. The South American growing weather will be a key watchpoint, as will Ukraine’s maize export capacity which is likely to fall to its weakest since 2017/2018.

Hi Pro Soya / Rapemeal

Rains have supported prospects for South American 2024/2025 soybean crops, with hopes for Brazil notably higher. The USDA currently estimates the Brazil Soybean crop at a record 169MT. However, other local commentators now suggest this could rise to 171MT.

A narrowing in the spread between Argentina’s official exchange rate and the market dollar rate has spurred farmers to sell again, which has improved crush rates in Argentina. Crush in Argentina rose 27% month on month in October, at a time when it is typically in seasonal decline.

Again, future prices could well be affected by the re-election of Donald Trump. Since his re-election there has been talks of the US imposing tariffs on China. This could potentially lead to China looking towards South America for their Soya.

Soya looks good value as a protein. With several of the good news headlines already being factored in the market, it is possible that there is limited downside on the current prices.

Rapeseed remains expensive as a protein. Pressure from the soybean market has been contrasted by lower world rapeseed levels this year. Therefore rapeseed prices are likely to remain firm for the short term.

Long-term, a higher Australian harvest and higher EU production outlook could offer some pressure to markets.