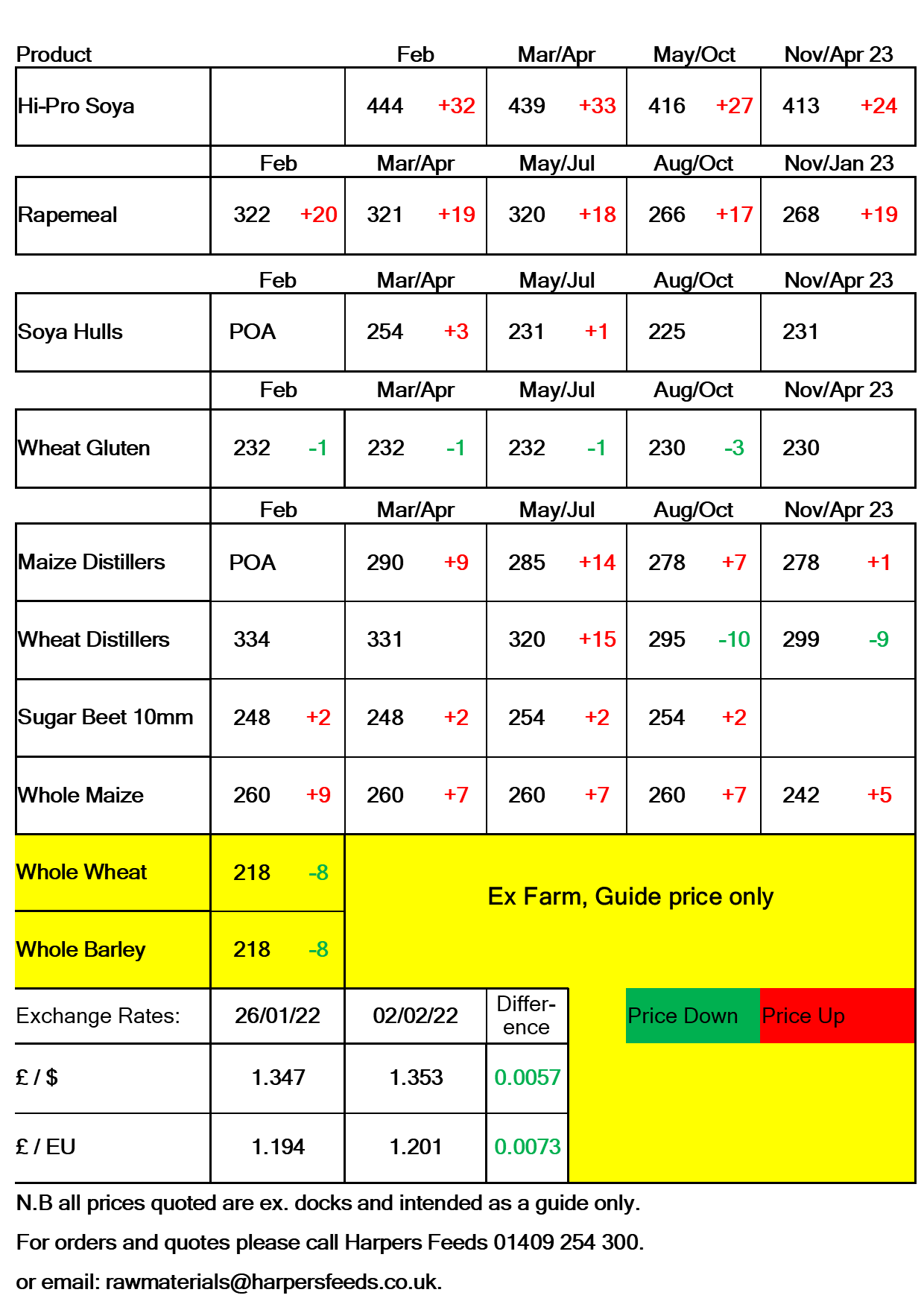

Wheat/Barley

After seeing global wheat prices rising for most of last week, we have begun to see prices ease over the past couple days.

Reduced fears over the tensions in the Black Sea have offered some relief in the market, however we are likely to see some big fluctuations as long as the tensions between Russia and Ukraine remain.

Rain is forecast for the US winter wheat areas which is much needed after negative effects were seen due to the recent drought and dry weather.

Global barley supplies remain tight until at least the Northern Hemisphere harvests. This will keep prices at a narrow discount to wheat until more is known about the 2022/23 barley crop.

Soya

On Monday two private forecasters sharply cut their estimates for Brazilian Soybean production. AgResource dropped its forecast by 6.0MT and AgRural dropped theirs by 4.9MT. This was on the back of the continued dry and hot weather seen in the southern areas of Brazil.

This contrasts with the USDA and Conab forecasts who have reduced estimates but still anticipate a record crop. If yields confirm a smaller crop than last year, global soybean stocks will be reduced which in turn will offer more support to global soybean prices.

Reports this week have been for a potential larger 2022/23 rapeseed crops than anticipated. If realised, we could see global rapeseed prices ease. However if soybean prices do continue to rise then any potential ease in rapeseed prices could be offset by the support to soybean prices.

Maize

Maize prices have also been supported by the South American weather. Although there was some rainfall in Mid-January which did bring some relief to the area, many reported that it was too short and too late. Currently there is very little rainfall forecast this week.

According to the Rosario Grain Exchange, rainfall in February is critical for final yields. Although the local reports have the Argentine crop forecast at 51MT, continued dry weather could see forecasts drop.